how to calculate sales tax in oklahoma

Oklahoma Sales Tax. Income tax 05 - 5.

Sales Tax Calculator And Rate Lookup Tool Avalara

Your average tax rate is 1198 and your marginal.

. Sales Tax Table For Oklahoma. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. Depending on local municipalities the total tax rate can be as high as 115.

20 on the first 1500 plus 325 percent on the remainder. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The average cumulative sales tax rate in Oklahoma City Oklahoma is 867.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. In Oklahoma this will always be 325. The excise tax for new cars is.

The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax. Alone that would be the 14th-lowest rate in the country. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 857 in Oklahoma County.

States have the right to impose their own taxes on residents and non-residents. The base state sales tax rate in Oklahoma is 45. Maximum Possible Sales Tax.

Tulsa has parts of it located within Creek County Osage. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Multiply the vehicle price before trade-in or incentives by the sales tax.

325 percent of the purchase price. The state sales tax rate in Oklahoma is 450. Oklahoma City has parts of it located within.

In Oklahoma this will always be 325. The Oklahoma OK state sales tax rate is currently 45. Multiply the vehicle price by the sales.

The Oklahoma state sales tax rate is 45. Maximum Local Sales Tax. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The average cumulative sales tax rate in Wilburton Oklahoma is 625. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Other local-level tax rates in the state of Oklahoma are.

If youve opened this page and reading this chances are you are living in Oklahoma and you intend to know the sales tax rate right. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

Sales Tax Table For Oklahoma County Oklahoma. Oklahoma Income Tax Calculator 2021. However in addition to that rate Oklahoma has.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 771 in Oklahoma. Oklahoma also has a vehicle excise tax as follows. Wilburton is located within Latimer.

Find your Oklahoma combined. The minimum is 725. This includes the rates on the state county city and special levels.

Average Local State Sales Tax. Oklahoma Sales Tax Rates. Multiply the vehicle price after trade-ins and incentives.

All numbers are rounded in the. This includes the rates on the state county city and special levels. Oklahoma State Sales Tax.

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

General Sales Taxes And Gross Receipts Taxes Urban Institute

States With The Highest And Lowest Sales Taxes

How To Calculate Sales Tax A Simple Guide Bench Accounting

Sales Taxes In The United States Wikipedia

Online Sales Tax Compliance Ecommerce Guide For 2022

How To File And Pay Sales Tax In Oklahoma Taxvalet

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Laws By State Ultimate Guide For Business Owners

Pdf Strategic Fiscal Interdependence County And Municipal Adoptions Of Local Option Sales Taxes

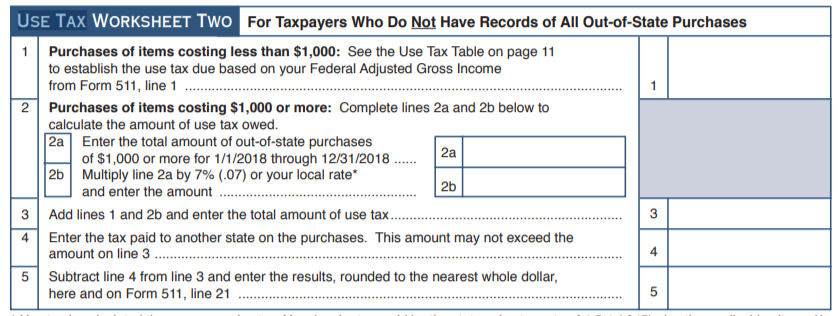

Do I Owe Oklahoma Use Tax Support

Online Sales Tax In 2022 For Ecommerce Businesses By State

Sales And Use Tax Rate Locator

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

How To Calculate Sales Tax And Final Price Youtube